Homebuyer Education Classes Daytona Beach & Surrounding Area

Thinking about buying your first home in Volusia or Flagler County? Between navigating mortgage options and figuring out down payment requirements, it can feel overwhelming. That’s why our

HUD-approved group education classes exist—to give you the confidence, tools, and certification you need to move forward.

Credit & Credit Scoring Workshop (July–December 2025)

If your credit score is below 640, our Credit & Credit Scoring Workshop is designed for you. This HUD-approved workshop helps Volusia and Flagler County residents understand how credit works and what steps can improve their financial readiness for homeownership.

What You’ll Learn

- How credit scores are calculated and what impacts them most

- How to read and use your credit reports

- Strategies for building or repairing credit

- How to prepare financially for renting or buying a home in Daytona Beach, Palm Coast, and surrounding areas

Requirements to Attend

- Three current credit reports (Experian, Equifax, TransUnion)

- One credit score (can be obtained from Experian)

- Completed prescreening and registration forms, submitted 3 business days before class

Free credit reports are available at annualcreditreport.com or by calling 877-322-8228.

Registration Process

Pick up forms at our office:

1834 Mason Avenue, Daytona Beach, FL 32117

Or contact:

Jennika Edgerton

- Phone: (386) 274-4441 Option 6

- Email: jennika.edgerton@mfhp.org

Workshop Schedule

How the Workshop Works

- Classes are offered virtually via Zoom.

- You’ll receive the Zoom link by email about 45 minutes before class starts—check both your inbox and spam folder.

- Bring your credit reports to class so you can follow along and take notes.

Download the Forms

→

Credit & Credit Scoring Workshop Flyer (PDF)

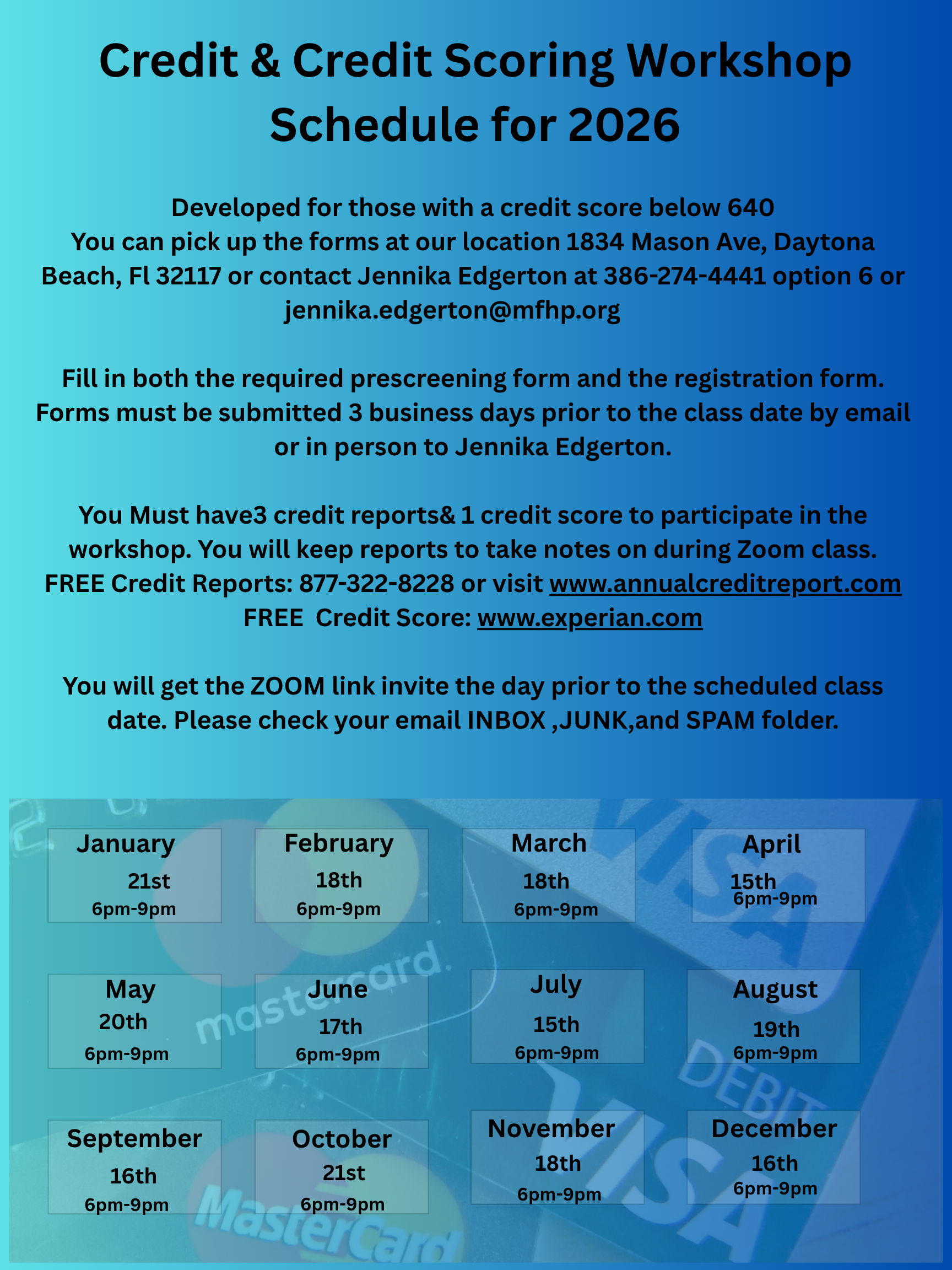

Credit & Credit Scoring Workshop

schedule for 2026

Developed for individuals with a credit score below 640, this workshop will help you understand, manage, and improve your credit.

How to Register

Pick up your registration and prescreening forms at:

1834 Mason Ave, Daytona Beach, FL 32117

Or contact:

Jennika Edgerton

Phone: 386-274-4441 (option 6)

Email:

jennika.edgerton@mfhp.org

Forms must be submitted at least 3 business days before your selected class date, either by email or in person.

Requirements

You must have 3 credit reports and 1 credit score to participate. You’ll use these reports for note-taking during the Zoom class.

Get your free reports and scores here:

Free Credit Reports:

www.annualcreditreport.com or call 877-322-8228

Free Credit Score:

www.experian.com

Class Details

All workshops are held via Zoom from 6 PM – 9 PM.

You will receive your Zoom link the day before your scheduled class.

Please check your email inbox, junk, and spam folders.

First-Time Homebuyer Workshops (July–December 2025)

Our HUD-approved First-Time Homebuyer Workshops are designed for individuals with a credit score of 640 or higher who are preparing to purchase a home in Volusia or Flagler County. These classes provide the education and certification required for most local down payment assistance programs.

How It Works

- Workshops are held in two parts (Part 1 and Part 2) and must be completed consecutively.

- Participants must also submit an end-of-course evaluation to receive the HUD-approved certificate.

- Classes are offered virtually via Zoom, with the link emailed to you 45 minutes before the start of class.

Registration Process

- Pick up forms at our office (1834 Mason Ave, Daytona Beach, FL 32117) or request them via email.

- Complete the prescreening form and the registration form.

- Submit both forms at least 3 business days prior to your class date. Forms can be returned by email or in person.

- Contact: Jennika Edgerton

- Phone: (386) 274-4441 Option 6

- Email: jennika.edgerton@mfhp.org

Upcoming Workshop Dates

Download the Forms

→

First Time Home Buyer Workshop Flyer (PDF)

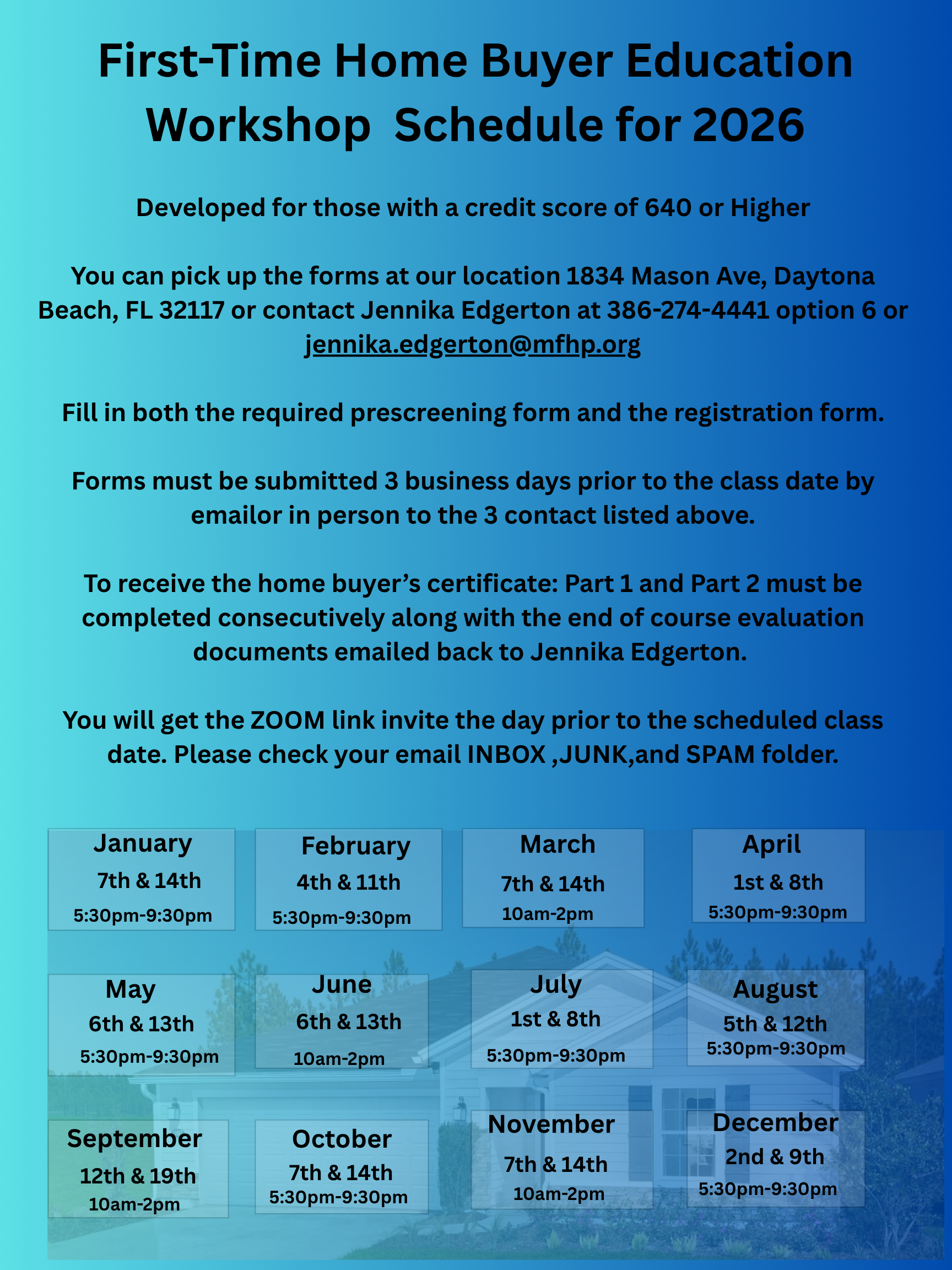

FIRST-TIME HOME BUYER EDUCATION WORKSHOP SCHEDULE FOR 2026

Developed for those with a credit score of 640 or higher.

How to Register

Pick up your prescreening and registration forms at:

1834 Mason Ave, Daytona Beach, FL 32117

Or contact:

Jennika Edgerton

Phone: 386-274-4441 (option 6)

Email:

jennika.edgerton@mfhp.org

Forms must be submitted at least 3 business days prior to the class date by email or in person to Jennika Edgerton.

Workshop Completion Requirement

To receive the Home Buyer’s Certificate:

- You must complete Part 1 and Part 2 consecutively.

- End-of-course evaluation documents must be emailed back to Jennika Edgerton.

Class Format

Workshops are held

via Zoom.

You will receive the Zoom invite the day before your scheduled class date.

Please check your email inbox, junk, and spam folders.

What You’ll Need Before Your Appointment

To make the most of your counseling session, you’ll need to bring recent credit reports from:

- Experian

- Equifax

- TransUnion

You can request your

free annual credit reports at:

www.annualcreditreport.com

Be sure to download or print your reports from all three bureaus. You can also access printable forms if you prefer to request them by mail.

If you need help accessing your reports, give us a call—we’re happy to walk you through it.

Why Work with Mid-Florida Housing Partnership?

We’re a HUD-approved housing counseling agency

As a HUD-certified agency, Mid-Florida Housing Partnership meets strict national standards for training, ethics, and client support. That means when you meet with our counselors, you're getting trusted guidance backed by federal standards—and tailored to your real-life goals.

We’ve supported local families for over 30 years

Since 1989, we’ve helped individuals and families across Daytona Beach, Palm Coast, DeLand, and surrounding areas take control of their housing journey. Whether it’s buying a first home, improving credit, or finding stability after a setback, we’ve been a steady resource through changing times.

Our staff understands the financial pressures facing people in Volusia & Flagler Counties

We live and work in the same communities we serve. We know what it’s like to juggle rent, food costs, rising insurance, and everything else that puts pressure on your budget. That local perspective helps us offer practical solutions—not generic advice.

We meet you where you are—without judgment

You don’t need perfect credit or a perfect story to work with us. Whether you're starting over, rebuilding after hardship, or just trying to understand your finances, we’re here to listen, guide, and support—not to lecture or shame.

Is This Only for Homebuyers?

No. While many clients come to us as part of their journey to buy a home, you do not need to be purchasing a house to use this service. We also work with renters, families rebuilding after financial hardship, and individuals preparing to move forward after a job loss, divorce, or medical event.

Ready to Take Control of Your Credit?

Improving your credit can open doors—not just to homeownership, but to a more stable future. We’re here to help you take that first step, no matter where you’re starting from.

→ Call today to schedule your session

→ Learn more about Homebuyer Assistance if you're preparing to buy

→ Visit our FAQs for more information